Blursoft Merchant Cash Advance is a financial solution designed to help businesses access the capital they need to grow and succeed. Offered by software company Blursoft, this service allows businesses to receive a lump sum of cash in exchange for a percentage of their future credit card sales.

One of the key benefits of a Blursoft Merchant Cash Advance is its accessibility. Unlike traditional loans, which often require collateral and a good credit history, a Blursoft Merchant Cash Advance can be obtained without these requirements. This makes it a potential solution for businesses that may not qualify for traditional financing, or that need access to funds quickly and don’t have time to go through a lengthy loan application process.

That said, you may want to consider the interest rate of such merchant cash advance loans as needing fast cash may be a problem for a lot of small businesses according to Forbes.

Pros of Merchant Cash Advances

Let’s look at some of the pros of getting a merchant cash advance from a company such as Blursoft.

Quick access to funds:

One of the biggest advantages of merchant cash advances is their speed. Unlike traditional loans, which can take weeks or even months to be approved and disbursed, merchant cash advances can be obtained in as little as 48 hours. This makes them a great option for businesses that need access to capital quickly.

No collateral required:

Another benefit of merchant cash advances is that they don’t require collateral. This means that businesses don’t need to put up personal or business assets as security for the loan. This can be particularly useful for businesses that don’t have the assets to offer as collateral, or that don’t want to risk losing them.

No credit check:

Most merchant cash advance providers don’t require a credit check as part of the application process. This means that businesses with poor credit histories or no credit histories at all can still access funding.

Flexibility:

Merchant cash advances are also flexible in terms of the amount of funding that businesses can receive and the percentage of their future credit card sales that they are required to pay back. This allows businesses to tailor the terms of their advance to meet their specific needs and goals.

Repayment based on sales

Another benefit of merchant cash advances is that repayment might be based on a percentage of the business’s credit card sales. This means that businesses only need to pay back the advance when they have the funds to do so, rather than having to make fixed monthly payments. This can be a useful option for businesses that have fluctuating sales or that are just starting out and don’t have a predictable cash flow.

Cons of Merchant Cash Advances

Let’s look at some of the pros of getting a merchant cash advance from a company such as Blursoft.

High cost:

One potential disadvantage of merchant cash advances is that they can be expensive. The fees associated with these advances can be higher than those of traditional loans, and the percentage of credit card sales that businesses are required to pay back can add up quickly. This can make merchant cash advances a costly option for businesses.

Short repayment terms:

Another potential drawback of merchant cash advances is that they often have shorter repayment terms than traditional loans. This means that businesses may have to pay back the advance more quickly, which can be challenging if the business is not generating enough sales to cover the repayment.

Risk of default:

If a business is unable to pay back a merchant cash advance, it may default on the loan. This can have negative consequences for the business, including damage to its credit score and potential legal action from the lender.

Limited use:

Merchant cash advances are typically only available for businesses that accept credit card payments. This means that businesses that don’t accept credit cards or that have a low volume of credit card sales may not be eligible for this type of financing.

Lack of long-term financing:

While merchant cash advances can provide quick access to capital, they are generally not a long-term financing solution. This means that businesses may need to find other sources of funding once the advance is repaid.

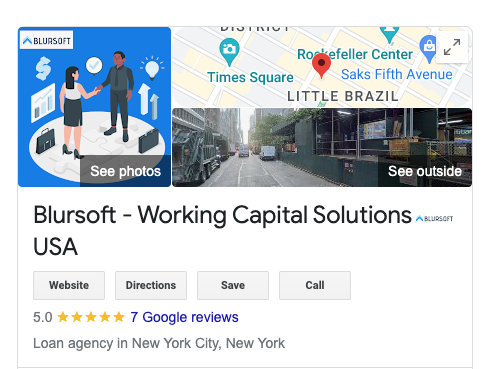

Blursoft Reviews

According to Google, Blursoft maintains a 5.0 rating based on 7 reviews. I could not find many other reviews covering the company from specific clients.

Conclusion:

Overall, a Blursoft Merchant Cash Advance can be a valuable solution for businesses that need access to capital quickly and don’t have the credit history or collateral required for a traditional loan. That said, it can be helpful to understand the pros and cons of a merchant cash advance to make the most informed decision.