This post may contain affiliate links, which helps us provide free content to our readers.

No, this is not a gimmick.

Yes, most of you can do this too. It’s also quite easy.

If you have read my blog for a while, you know I cover a great deal on Dave Ramsey and get out of debt techniques. So, you may read this article and think that I condone getting into debt. Wrong. However, I find the benefit to utilize the system to get big perks like travel for free.

So, what’s the story?

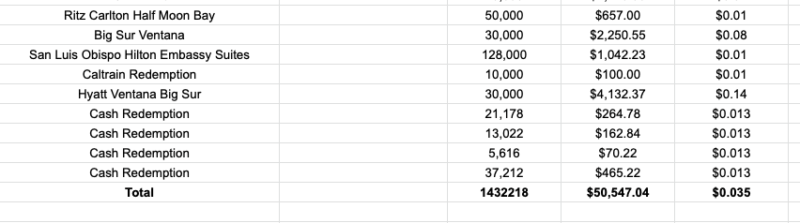

My wife and I really like traveling. In 2014, I wondered whether I could find a way to travel for free wherever we wanted to go. Well, now 7 years later, I would say that it works pretty well. Below is the tracker that we use to understand how much value we have been getting from our points.

Okay, so how? The answer is through prioritizing credit cards that provide bonuses based on the amount you’ve spent over a certain time frame. You also get points for daily spending. For example, right now, my absolute favorite card is this Chase card that offers an astounding 100,000 points bonus. This can equate to 3 free nights at a $2,000 per night hotel, so over $6,000 in value!

Now, please note that I would NOT recommend this to anyone that has outstanding balances. I would also NOT recommend this to someone who doesn’t pay off the balance at the end of each month. The banks provide these bonuses because many people will pay the interest, which can negate the value of the bonus.

One of the Perks: $4,000 Per Night Hotel For Free in 2021

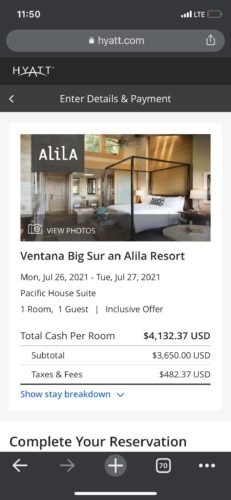

So, when one of our favorite cards had a large signup bonus, we went for it. Then we transferred only 30,000 points to the Hyatt points program. Next, I looked quite religiously for a while to see how we could book the Ventana Big Sur, which is an all-inclusive hotel in Big Sur, CA. Yes, I guess I would hope that it’s all-inclusive for $4,132.37 per night!

Finally, I found it and booked it right away. I later measured how much the room would have cost if we used cash. Check it out below.

How Was The Stay?

It was incredible. The staff was very friendly. They provided a free upgrade to the Big Sur Suite that came with a hammock and a wood-burning fireplace. The food was incredible as free food tends to always be that way, doesn’t it? We have stayed in many of the Hyatt’s in the bay area (See our recent Hyatt Regency Monterey review), and the Ventana is my far my favorite.

Here are a few pictures from our stay:

Thankfully, we were able to book another stay for our anniversary. Okay, so how can you do it?

How Do I Do It?

First, I always look for credit cards with the best bonuses!

Let me go step by step to show how you can do it as well. The gist is that you get a Chase credit card that has a great bonus right now then you transfer those into Hyatt. You may not be in California, but there are Hyatt hotels all over the United States. Here’s the list of the other Hyatt hotels you can book with points.

Process

- You would apply for this Chase credit card (I am able to provide fun, free content from referral links like this one). Currently, with this link, you would get 100,000 bonus points, which may be the most ever.

- You generally get a decision within about 30 seconds. If you don’t, here’s the Chase reconsideration line: 1-888-270-2127

- You would need to spend $4,000 on purchases in the first 3 months from account opening.

- At the time of the writing, you would get 80,000 points added to your Chase account.

- You would then transfer the number of points you would like to send to a Hyatt account through the Chase transfer portal. Don’t have a Hyatt account? You can enroll here.

- Next, once the points show up in your Hyatt account, you can book the hotel room.

Requirements

- According to Credit Karma, the average required score is 736.

- Chase has a 5/24 rule, which essentially means, “…that you can’t be approved for most Chase cards if you’ve opened five or more personal credit cards (from any card issuer) within the past 24 months.“

What Else?

I just recently got excited about credit card points again, so please feel free to write any questions in the comments. Reach out if you’d like my free points tracker. Also, feel free to subscribe below.