It was a daunting task for me to convert my Schwab account from traditional to Roth IRA that I delayed the process for month, but in reality, it took about 10 minutes. Also, this worked for me, but I am not sure if anything changed, so just be aware of that upfront.

And, it was so simple that I wanted to put this simple step-by-step guide because I felt the other guides online were confusing and hard to follow. Here’s how you do it in 10 minutes.

Here’s one of the most important things:

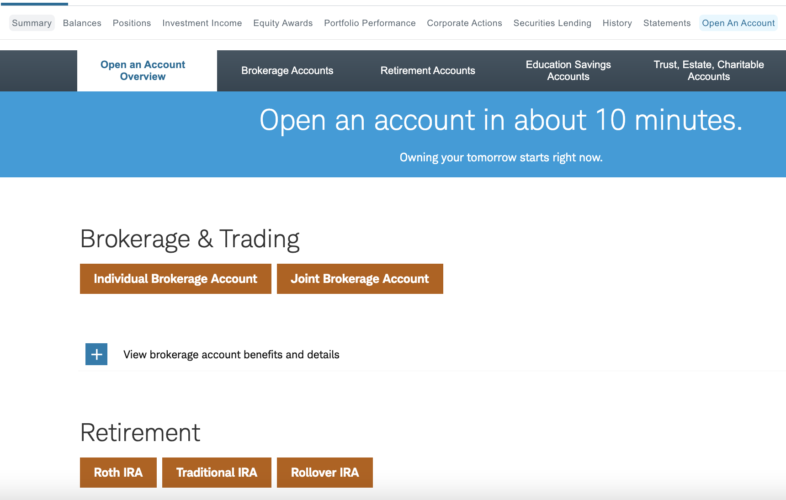

- You have to create and open a new Roth IRA account and then do the transfer. I thought I was just going to transition the account without opening a new Roth IRA account. So, first, you would go to this link once signed in and then you would click on Roth IRA.

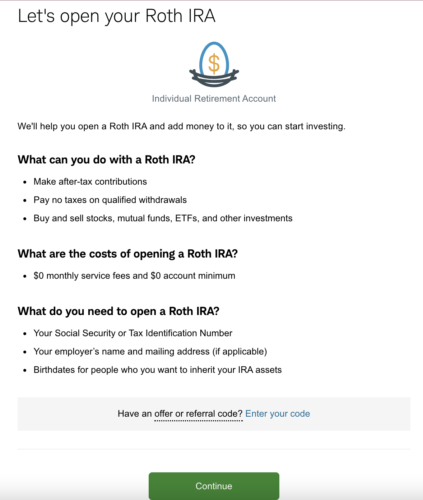

1. Here’s the “Get Started” page.

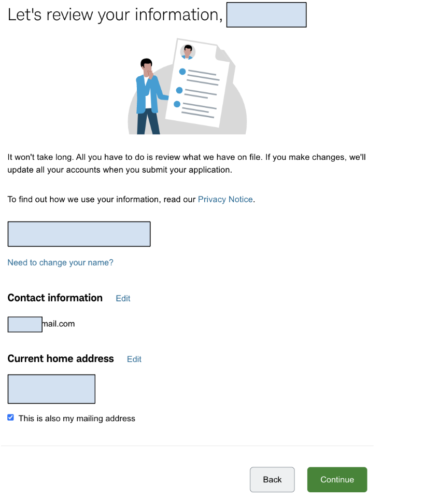

2. Review Your Information

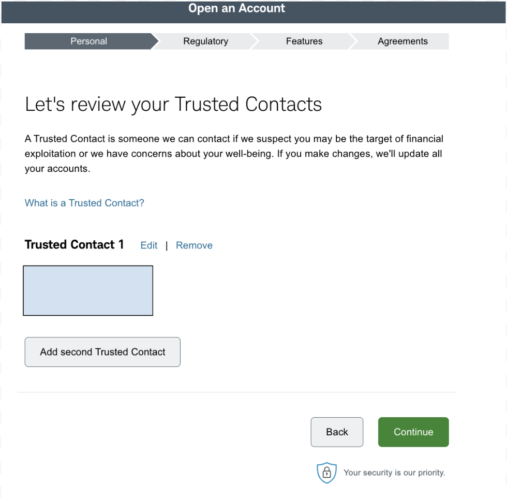

3. Review Your Trusted Contact

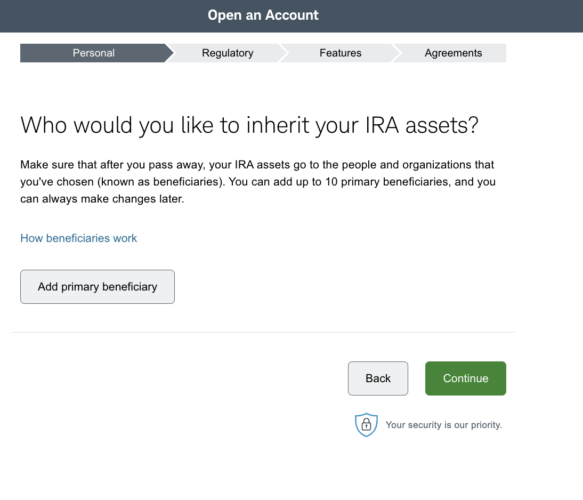

4. Add A Beneficiary

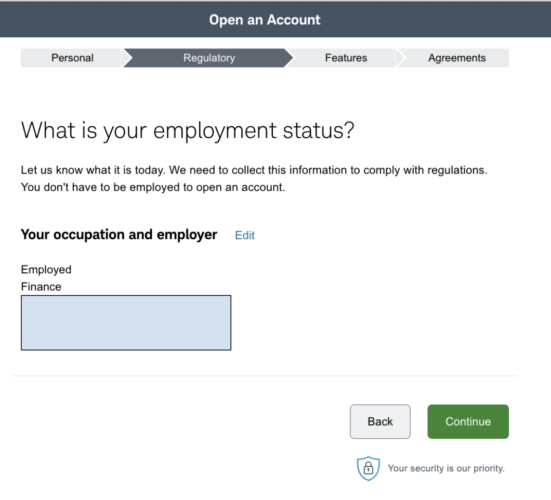

5. Your Employer Information

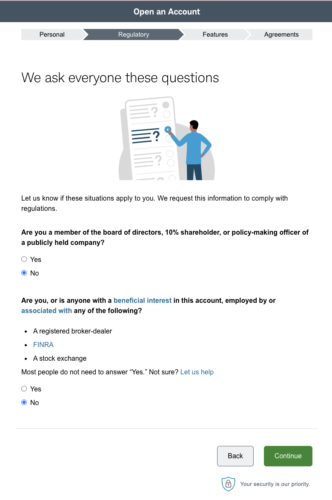

6. Public Stock and Board of Directors Questions

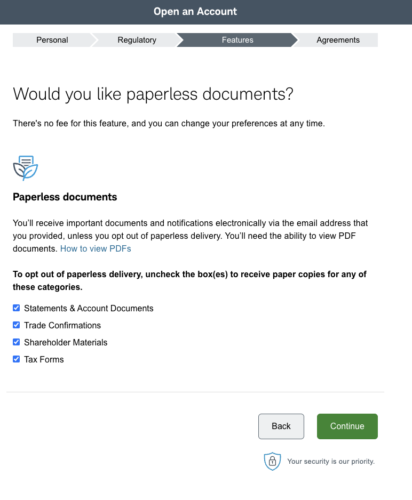

7. Go Paperless Documents

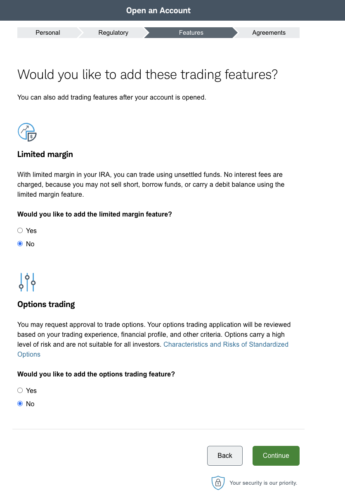

8. Options and Margin Trading

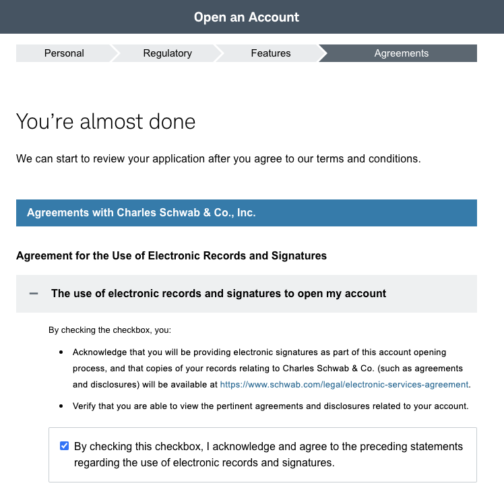

9. Electronic Signatures to Open Schwab Roth IRA

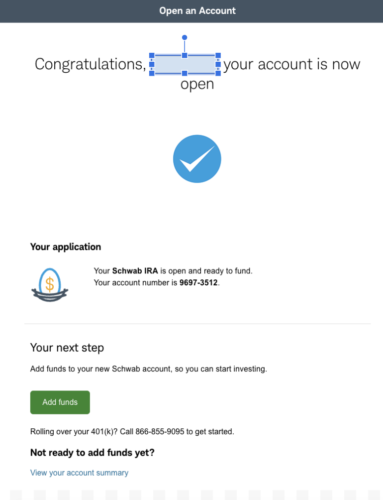

10. Account is now open

Now It’s Time to Transition the Account from Traditional IRA to Roth IRA

Let’s now go through the process to transition and move money into the Roth IRA from your traditional IRA.

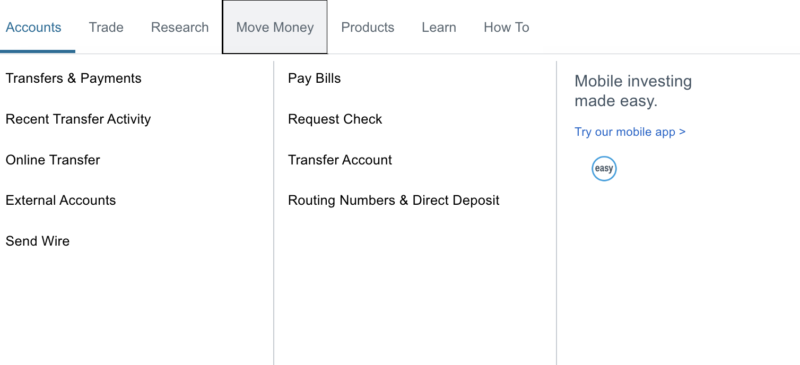

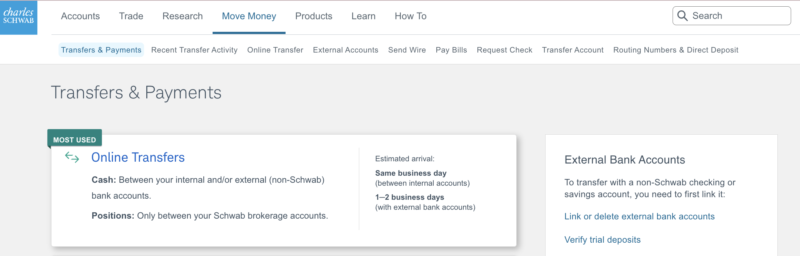

1. Moving Money

2. Transfer and Payments

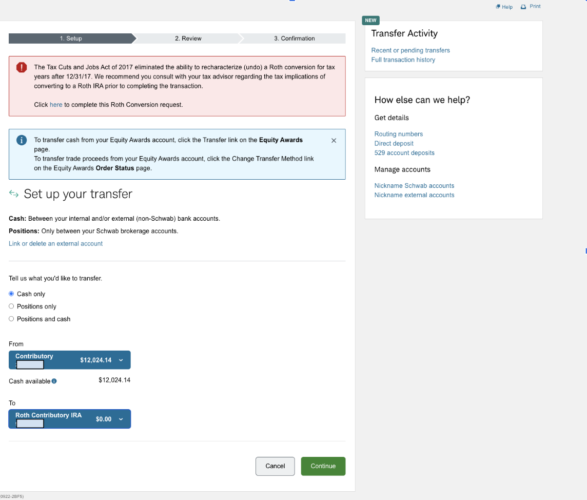

3. Setting Up The Transfer from Your Traditional IRA to Roth IRA

For me, I went to the red box, and clicked on the “Click here to complete the Roth Conversion request”.

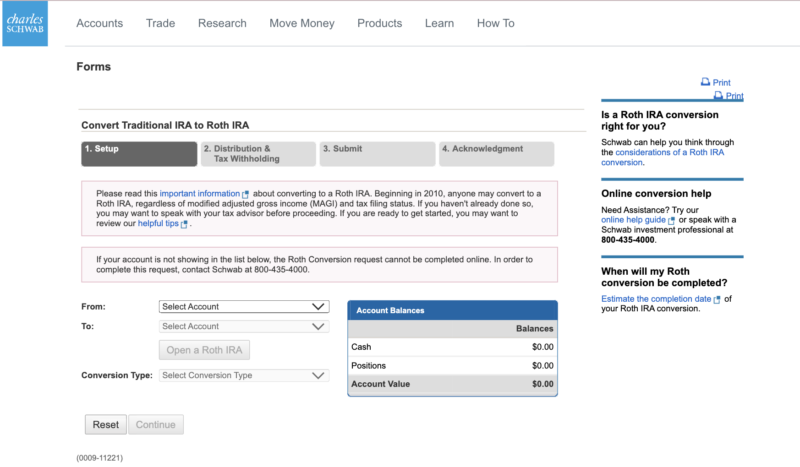

4. Next, it will take you to the Schwab Convert Traditional IRA to Roth IRA

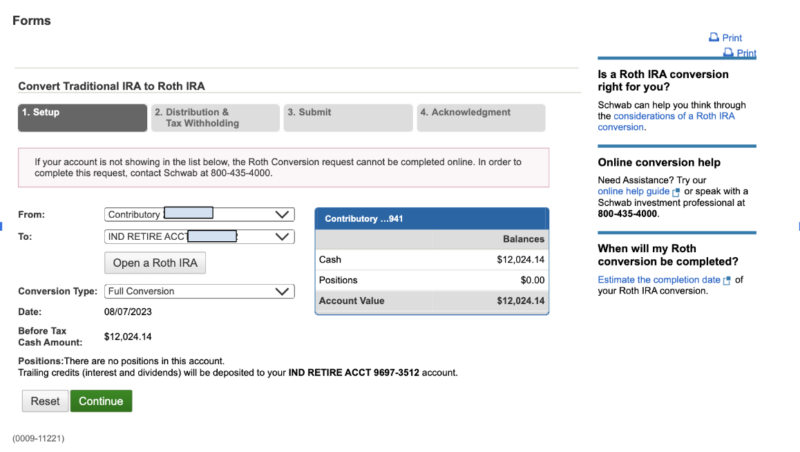

5. Add account information for conversion

6. Review Final Questions

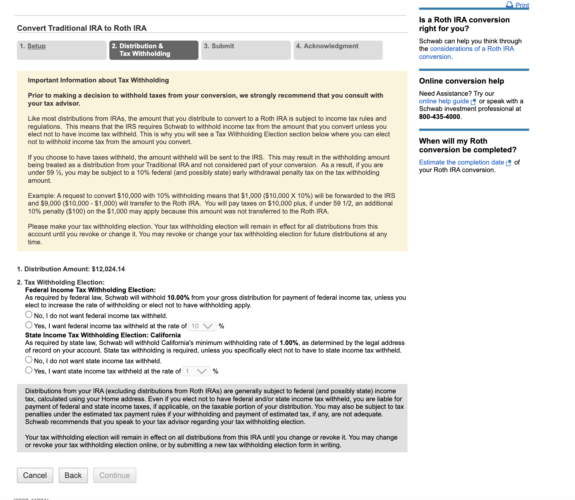

Next, you would select information related to withholdings. I believe I selected no for both of these.

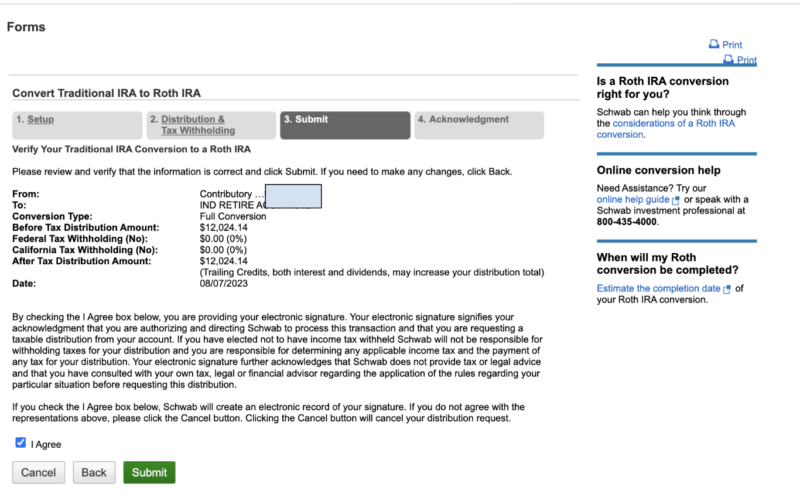

7. Check and review and submit Schwab Roth IRA conversion

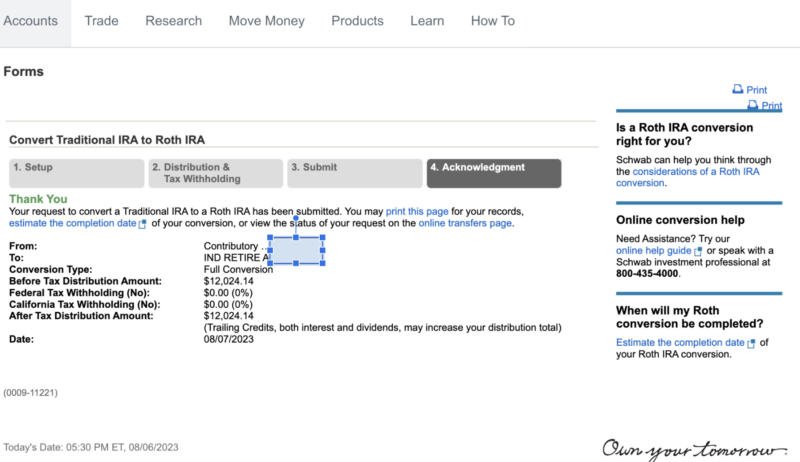

8. Thank You – Schwab Conversion

What’s Next After The Backdoor Roth IRA conversion?

Here are the things to consider after filing the conversion.

Voila, that is the simple backdoor Roth IRA conversion process from a traditional IRA, which can be another investment vehicle or you in addition to potential mutual fund investing. Please comment below if you have any questions or email me at savedbythecents@gmail.com.