Please note that this article may contain links that help support this website.

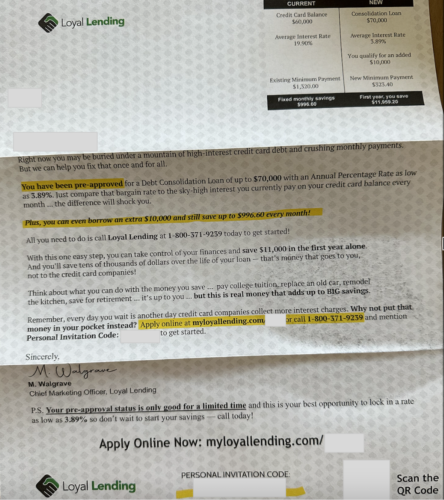

Did you receive a mailer from Loyal Lending offering a pre-qualified debt consolidation loan for under 4%? Not only that, does it say you qualify for additional cash? If so, you may be wondering if this offer is legitimate and whether Loyal Lending has a BBB page.

In this article, we’ll dive into the reviews and what to know about Loyal Lending.

What Is Loyal Lending?

I discovered Loyal Lending through a conversation with a person who I will call Bill, who received the same mailer and applied for the loan. According to Bill, he didn’t qualify for the pre-approved loan, but was offered a debt consolidation program. It appears that Loyal Lending may be a marketing company that promotes debt settlement / debt consolidation programs, which are not the same as debt consolidation loans.

If you’re in the market for a debt consolidation loan, we’ve vetted two companies that offer soft credit checks and no prepayment penalties. In addition, with soft checks, this means that you can check your rate on multiple sites to optimize the BEST rate.

Here are two of our favorite debt consolidation loan companies:

Upstart – Check Rate (Credit score not affected when checking rate)

Upgrade – Check Rate (Credit score not affected when checking rate)

Let’s now cover the Loyal Lending BBB.

Loyal Lending BBB

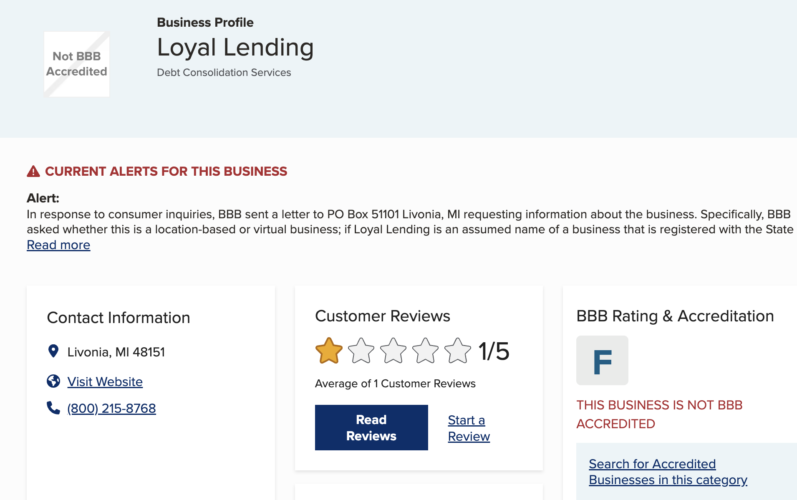

Per BBB, Loyal Lending currently has an F rating. That said, it has only 1 rating and 1 complaint.

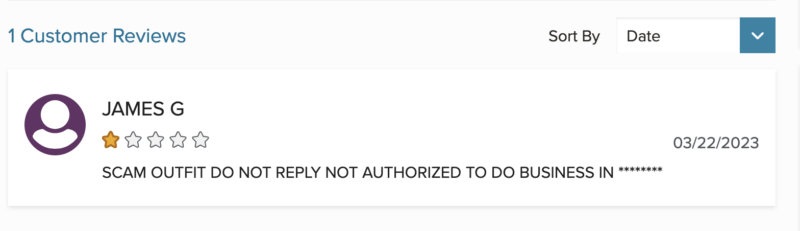

The only BBB review alleges that Loyal Lending is a scam outfit, but the reviewer does not provide many details, so I’m not sure what to make of it.

When clicking to read the 1 Loyal Lending BBB complaint, it unfortunately didn’t load any specific complaint.

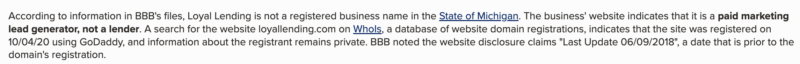

Furthermore, BBB stated that this is indeed a lead generator, and not an actual lender.

Other Reviews

Moreover, Google reviews led to a different Loyal Lending focused on mortgage loans, not credit card consolidation like the Loyal Lending mailer advertised.

Is Loyal Lending Legit?

From my research, Loyal Lending may just be a marketing firm that does not actually provide loans. That said, it may send mailers to get people interested about a debt consolidation loan product.

Furthermore, a visit to the Wayback machine revealed that the Loyal Lending website may not have even existed until recently. For example, Wayback machine just shows that the Loyal Lending’s first scrape was from December, 2022.

Notably, Loyal Lending’s mailer only lists a PO box, raising questions about the company’s operations. Despite these challenges, Loyal Lending remains an option for debt settlement. While debt settlement can be less expensive than current obligations, it’s crucial to weigh the debt settlement pros and cons associated with it.

For example, debt consolidation loans can positively impact credit scores, while debt settlement can have the opposite effect. You may also want to consider how much debt relief costs.

Other Reviews

Unfortunately, finding reliable reviews for Loyal Lending is a challenge. Loyal Lending’s mailer also seems quite similar to Patriot Funding. Additionally, no other reviews for Loyal Lending were found, adding to the confusion. Therefore, those considering Loyal Lending should proceed with caution and conduct extensive research before making any financial commitments.

The history of Loyal Lending isn’t quite clear, as it’s difficult to identify what type of company it is. From a conversation with a person named John, it seems that Loyal Lending is a marketing service that refers clients to other debt settlement firms.

It’s unclear if Loyal Lending ever refers people to debt consolidation loan companies or if anyone actually gets the advertised 3.89% interest rate.

Conclusion

So, if you’re still in the market for a debt consolidation loan, it may be helpful to check rates on actual lenders that only do soft checks for checking your rate and provides no prepayment penalties.

Here are two of our favorite debt consolidation loan companies:

Upstart – Check Rate (Credit score not affected when checking rate)

Upgrade – Check Rate (Credit score not affected when checking rate)

If you’re struggling with debt and can’t obtain a debt consolidation loan, don’t worry, as you still have options. If your monthly card payments exceed your debt reduction, or if you have a high debt-to-income ratio, you may qualify for debt consolidation, but the interest rate could be as high as 29.99%. Fortunately, we created a free debt options and costs calculator to help you compare options such as non-profit credit counseling, debt settlement, and debt payoff planning. If you’re in financial hardship, the calculator also provides information on bankruptcy. No email address is required, unless you need additional free assistance.