M1 Finance Investing Platform Review for 2022

This post may contain affiliate links, please read our disclosure for more information.

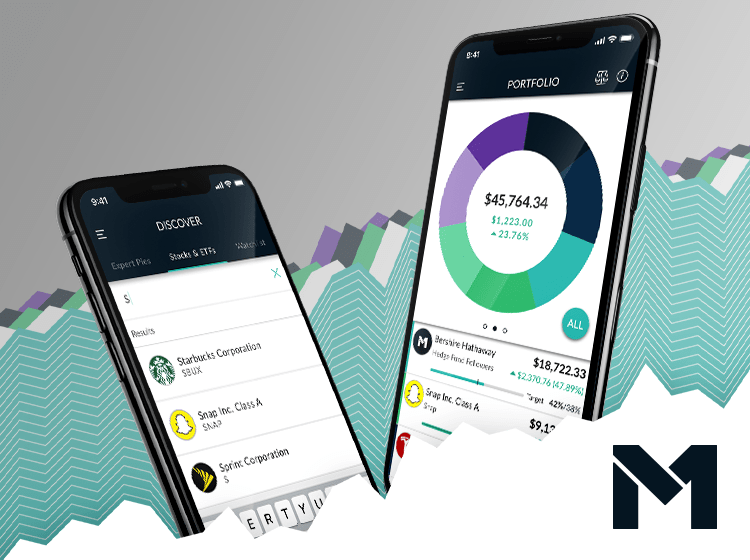

Could this be the future of online retail investing? We have been testing M1 Finance using both their mobile IOS app and the online web platform for the past month. Here’s what we’ve found so far:

M1 Finance is a $0 fee, $0 commission online broker for stocks, bonds, ETFs and IRAs which also utilizes fractional shares.

If you are new to investing in the stock market this should help clear up things. Fractional shares allow you to own a fraction of one share of stock. Rather than requiring you to purchase one full share which is what traditional brokers require. This provides a very minimum barrier to entry. Especially getting into stocks like Amazon which is currently over $1,800 for one share. A new investor can now own Amazon stock with only a few dollars, until now it would have not been possible.

Another great feature of M1 Finance is their pies. Pies represent your portfolio and can be manually created or you have the option to select pre-made pies which are sorted by industry type, risk tolerance, or both. They even have expert pies that mimic large hedge funds like Berkshire Hathaway, Green Light Capital, and Icahn Capital. Otherwise, you can select an expert pie from ultra-conservative all the way up to ultra-aggressive with pre-selected stocks. Maybe you just want a high yield dividend portfolio, they have a pie for that too!

Once your pie is selected, you will see the slices.

Each slice can represent either a stock or could be sliced with more stock slices inside. One of the best features of M1 Finance is the ability to decide how much weight (percentage) you want allocated to each slice before investing. Not hot on tech stocks? Okay, lower the weight of those slices. Want to go heavy on telecom? No problem, just select what percent to allocate to those slices and boom the system will allocate accordingly.

Now this is where the cool part comes in.

M1 Finance allows fractional share combined with weighted slices, automatic investing and re-balancing. Say you setup M1 Finance to automatically withdraw from your checking account $250 per week. M1 will automatically purchase fractional shares throughout your pie slices. Maybe your cannabis stock slices went up 50% in the last week and your financial services stock slices went down 2%. The system will invest and balance your portfolio (pies) to automatically be weighted to your presets. How cool is that?

Dividends are a big part of investing in the long term. M1 Finance will take cash dividends and reinvest them automatically for you. One thing we wish M1 Finance would fix is to have it automatically reinvested into the same dividend-paying stock instead of spread across the pies. We believe in the future they will come up with a solution for this

Did we mention no fees or commissions? A typical online brokerage will charge per trade anywhere from a few bucks up to as high as $7 – $10. A mutual fund can have a high expense ratio and high fees. Once you see how easy M1 Finance is you may just ditch your current broker. You can also borrow against your invested funds through their website. Similar to a loan Just be careful of margin/maintenance calls if you are invested in higher risk stocks or ETFs.

Don’t want to hassle with your current broker?

No problem. M1 Finance has you covered! You can actually transfer your securities over to their platform and M1 Finance can also handle a 401k rollover or 403b rollover. Beware there may be a small fee to transfer stocks from your old broker to M1 Finance, so be sure to read the fine print.

The only drawback we see with M1 Finance (if any) is the ability to day trade or swing trade. This is a buy-and-hold long-term investing strategy platform. If you’re looking to make frequent buys and sells and are looking for margin leverage, then this platform may not be for you. But if you want to invest in the proven method of buy and hold, plus reinvested dividends. Then this is your new long-term wealth machine.

Overall, we are impressed with this platform and give it a 9.5/10 Saved by the Cents rating.

Click here to visit the M1 Finance website to sign up.