You may have just started your Dave Ramsey journey and wonder how to master Baby Step 1 and Baby Step 2. I don’t recommend many tools for various reasons, mostly because I am OCD about the tools I use.

This is why that I was extremely surprised how much has Savvy has helped me along in my Baby Step 2 journey.

You are probably thinking of using a pencil and paper or Excel for your debt payoff planner. I thought the same thing until I met Savvy.

Now, let’s jump into what I like and what I want to see in the Savvy Debt Payoff Planner.

What I Like about Savvy Debt Payoff Planner

There are a number of features that I like about Savvy, so let’s start with what I really have liked to see in the application.

1. Savvy Can Save You A Lot Of Money vs Snowball

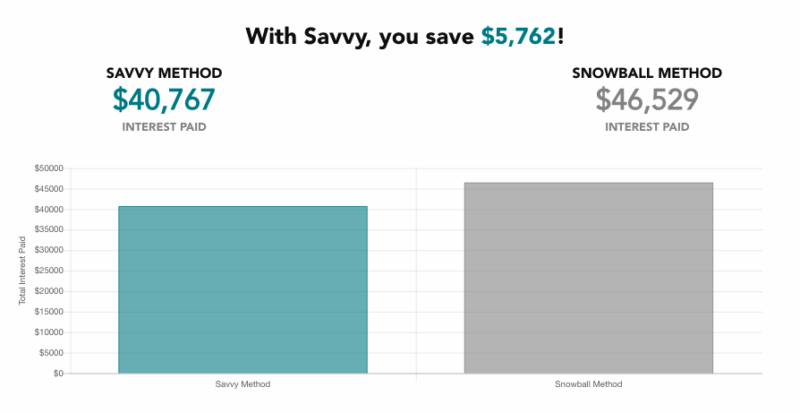

Although Dave Ramsey swears by the snowball method, I also know that you can lose thousands (that’s right, thousands) of dollars in interest payments.

How? If your smallest payments also have the smallest interest rates.

Don’t believe me? See the example below. Do you want to see how much you would lose using snowball method? Use the same calculator as the one below to estimate how much you would lose using snowball method.

Understand the Savvy Debt Payoff Method.

Savvy has a free and paid version. And, I have high expectations for applications that cost money. Savvy provides a free trial and then $5.99 per month. It’s still priced lower than the YNAB and the Every Dollar Plus of the world, but I need to make sure that it provides enough value to justify the cost. Thankfully, the Savvy Debt Payoff Method feature may justify the price by itself. Let’s dig into the numbers.

I personally like the psychological benefit of the snowball debt payoff method, but I strongly dislike the fact that you could lose a lot of money on interest if your smallest debts have the lowest interest rates. I like the savings aspect of the avalanche debt payoff method, but I strongly dislike you don’t get the psychological benefit of paying off a smaller debt if your largest debt has the highest interest rate.

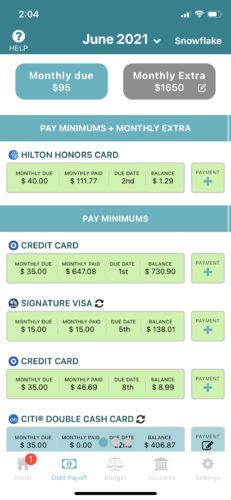

Finally an application that does it and does it automatically. The Savvy Debt Payoff Planner combines the snowball and avalanche method to create the Savvy Debt Payoff Method. Once you payoff your minimum debts each month, Savvy will tell you how much to put towards your next debt.

2. Savvy Really Encourages You

Savvy tracks data that really encouraged me to stick with the program. Take a look at this graph which shows how my debt freedom date has moved 3 MONTHS closer.

3. No ADs

Ads can be obnoxious. That is why I am elated that neither version has any ads. Thank you, developers.

4. Automation and Manual Options

You see web and mobile applications that provide the manual option, but don’t allow you to automatically connect to your bank accounts. Then you see other options that are 100% automatic and don’t allow you to add cash transactions and payments. I really like how Savvy lets you add manual and/or automatic accounts because I like flexibility.

Savvy automatically pulls all of my income and transactions and puts them into my debt payoff plan. I can even track autopay accounts!

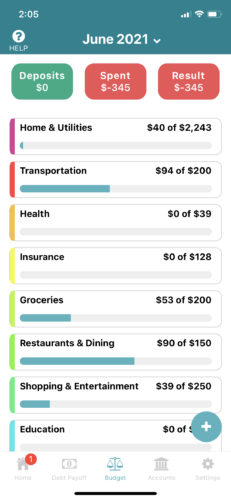

5. Savvy Has A Zero Based Budget

One of the hardest things about Baby Step 1 and Baby Step 2 is that you have a budget and then a separate debt payoff plan. You no longer need to do that as Savvy has both a zero based budget and a debt payoff plan. Voila.

6. Income and Expenses Tracking

It’s difficult to know how much you will have extra each month to pay towards your debt without knowing all of your income and expenses. I really like how Savvy allows you to track your income and expenses to let you know at the end of the month how much extra you can pay towards your debt. This feature may allow you to save more money on interest because you may have more at the end of the month to put towards your debt than you think.

7. Data Accuracy

I like that Savvy allows you to add manual cash transactions and ignore or delete transactions. It may not seem like this is an important feature, but the fact is that a debt payoff planner that provides insights should only give insights when the data is accurate. Thankfully, Savvy is quite accurate and seems to be getting more accurate by the day.

What I’d Like to See in Savvy Debt Payoff Planner

Savvy may be a newer application on the market as I have not seen many reviews. It has a lot of functionality, but here are two features I’d like to see in the next year.

Uploading Manual Transactions:

If you add your accounts manually, you will be tracking your income and expenses. It can be tiring to manually add your transactions. You may want to add the income and expenses in spurts. That said, I’d like to see a feature that allows me to automatically upload the transactions.

Web Version:

I would imagine that this is in Savvy’s future, but I would like to see a web version of Savvy. Why? I do so much on my phone and I like that it’s an icon on my home screen. That said, it would also be nice to be able to view my debt payoff planner online when I am at work or away from my phone.

Conclusion

We believe that the Savvy Debt Payoff Planner on iOS and Android has the most potential. So, I wanted to write an article specifically about the mobile application. Also, I really like that Savvy Debt Payoff is also available on Android because my wife has an iOS, and I have an Android, so we can both access the application.

You may be looking for a debt payoff planner that will join you on your debt-free journey. Although there are a number of debt payoff planners out there, I thought that Savvy offered the most potential. What about you? What is your favorite debt payoff planner and why?